Our investment processes and methodologies have been honed and proven over many market cycles. While based in fundamental research, we believe that our relentless vetting of companies of interest provides an edge in the small cap market. The industry networks that each team member has developed over years of investing are integral to the process – from idea generation to the validation of the value proposition that each company provides its own customers.

At A Glance

- GIM separates companies from stocks and looks for strong businesses well-positioned for growth

- We may follow a good company for years before investing in the stock

- Once a company has been validated, we turn to the stock

- We seek to invest in the stocks of well-positioned, vetted companies when risk/reward is attractive

- We have conviction in our analysis and patience with our conviction

Lifecycle Diversification: Why We're Different

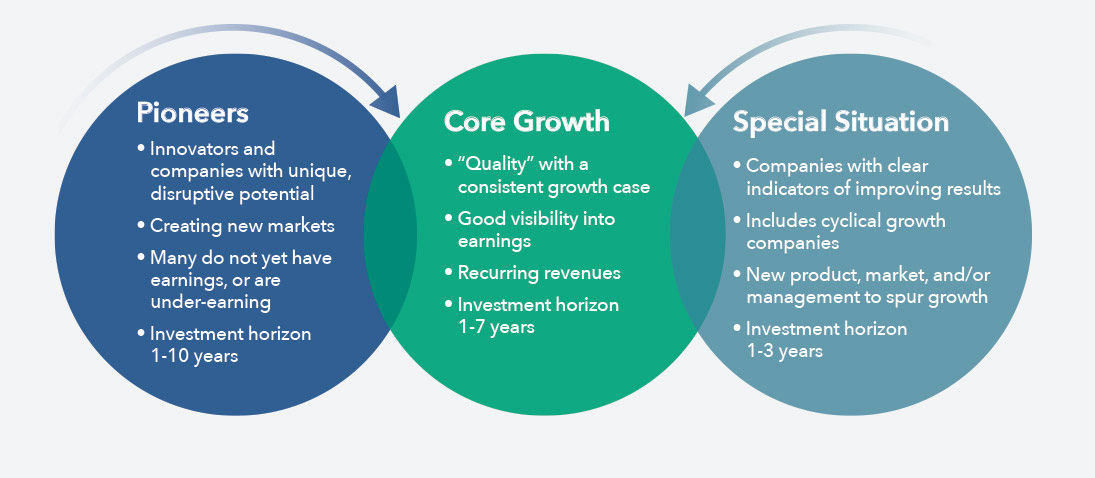

Every company is classified by LifeCycle: Pioneer, Core Growth, or Special Situation. The LifeCycle categories have distinct performance drivers and attract different types of investors, providing an important diversification in the portfolio. LifeCycles expand the opportunity set, though all companies considered have a powerful growth case and are either market leaders or are taking market share.

GIM’s investment processes have been crafted, honed, and are implemented by our dynamic team of highly experienced and proven investors. Our team’s interests are directly aligned with those of our clients.

GIM attracts and retains dedicated employees who are motivated and work as a team for our clients’ goals.

- Employee-owned shop

- 25-years average experience

- Every portfolio manager is also an analyst

- Each team member has core areas of industry expertise

- Collaboration and cross-pollination of ideas are embedded in the GIM culture

Investment Culture

We believe the power of the individual grows exponentially through our process and team dynamics.